We handle the paperwork, policies, and portal submission.

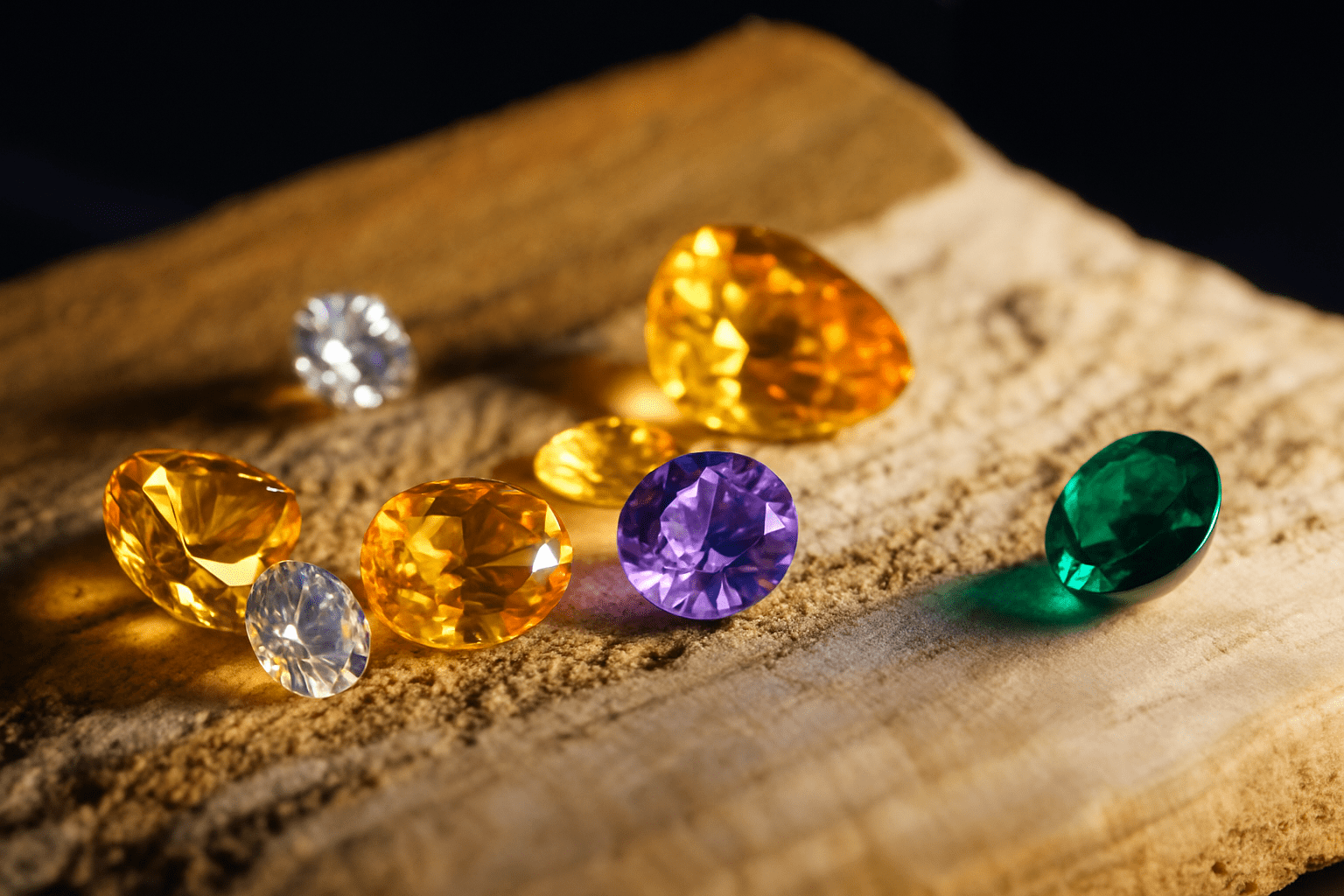

Who Needs To Apply

Flip to Find OutAuction houses

Bullion traders

Second‑hand dealers

Wholesale & Retail Jewelers

Trading platforms and Businesses dealing in Precious Stones, Precious Metals or Precious Products (PSPM).

Still unsure? Chat with us to find out more.

For jewelers, bullion traders, auction houses, second‑hand dealers, trading platforms and other businesses dealing in precious stones, precious metals or precious products (PSPM).

Why work with Alder

Flip for moreOur Promise

✅ Specialists in AML/CFT for PSPM – We translate regulatory speak into practical steps for your operations.

✅ Handholding – From GoBusiness submission to answering Registrar queries.

✅ Customised Policy – Not generic templates; we tailor to your risk profile, outlets, and channels (retail, e‑commerce, wholesale).

✅ Speed with accuracy – Clear document checklist and prompt drafts keep the application moving.

What We Do

- Free Readiness Check

- Incorporation of Entity (if not already done)

- Document Preparation (eg. Compliance / Onboarding framework and processes)

- GoBusiness Submission Step by Step Guidance

- Liaising with Ministry of Law Officers

- Post-Approval Onboarding

What We Need From You

- Business Profile & Outlet Particulars

- Key Persons Particulars

- Corporate Structure

- Existing Compliance Artefacts (also included in our service)

- Internal Policies, Procedures and Controls (IPPC)

- CDD/ECDD Forms

- Staff Training

- Sanctions Screening

- Cash & Suspicious Transaction Report (CTR/STR)

Fees & Timeline

Flip to Find OutFee Schedule

Government fees (payable via GoBusiness)

Application fee: S$120 (one‑time per application)

Registration fee per outlet (annual):

Class A: S$250 per outlet (≤ S$2,000 net price per item)

Class B: S$350 per outlet (any value)

Alder professional fees: Fixed‑fee engagement depending on outlets and complexity. Get a quote below.

Registration is annual; we can diarise renewal support and staff refresh training.

FAQ.

- Do foreign‑owned or multi‑layered companies need to disclose their Ultimate Beneficial Owners?

Yes, provide an organisation chart up to the individuals. If a shareholder is a listed company, list holders of >5%. - Class A vs Class B – how do I choose?

Pick Class A if every PSPM item’s net price is < S$2,000. Otherwise select Class B. Different outlets can be declared within the same application; fees are per outlet. - How long does approval take?

Around 4 weeks after a complete submission; longer if the Registrar requests more information. - Is a Compliance Officer mandatory?

Yes—each registrant should designate one. Besides assisting to define responsibilities and training, we also offer Outsourced Compliance Officer. Talk to us to find out more.