by jiawen

Share

Share

Understanding the RFMC Regime: A Path to Transition

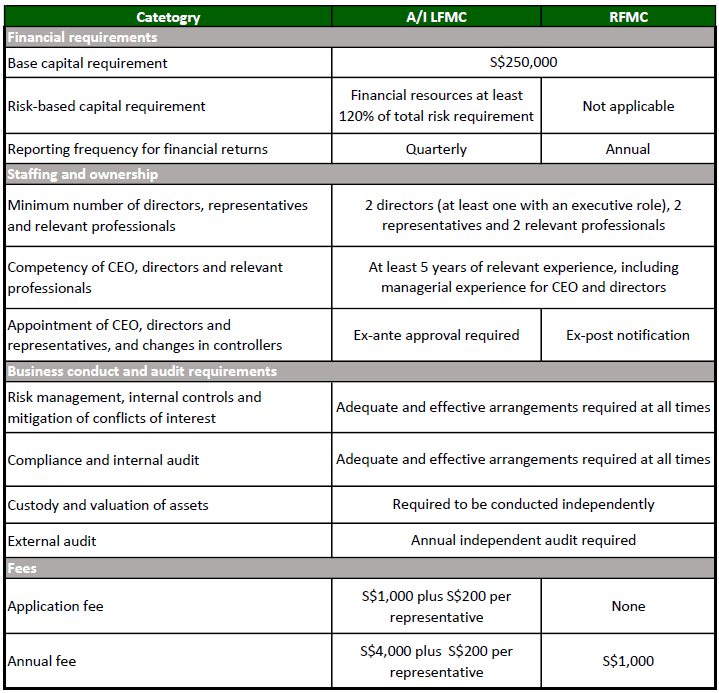

The RFMC regime emerged as a transitional framework post-EFM repeal, providing fund managers with a pathway to transition into a fully regulated environment. MAS crafted the RFMC regime with tailored admission criteria and business conduct requirements, recognizing the diverse profiles and needs within the fund management sector. Under this regime, fund managers adhered to specific guidelines concerning risk management, asset custody, and asset valuation, akin to standards applicable to Licensed Fund Management Companies (LFMCs) serving accredited or institutional investors.

While both RFMCs and Accredited/Institutional LFMCs (A/I LFMCs) operated under similar principles, nuances existed primarily in reporting requirements and fee structures. RFMCs enjoyed lower fees but faced limitations in asset management scope and investor outreach.

MAS’s Proposal and Stakeholder Engagement: A Collaborative Approach

MAS’s decision to repeal the RFMC regime signifies a significant milestone in Singapore’s regulatory evolution. Through a consultation paper released in 2023, MAS invites stakeholders and interested parties to contribute insights and feedback on the proposed transitional arrangements for existing RFMCs post-repeal. This consultation process underscores MAS’s commitment to stakeholder engagement and regulatory transparency, providing industry participants with a platform to voice perspectives and concerns.

In navigating the complexities of today’s financial landscape, MAS remains steadfast in its pursuit of a regulatory environment that fosters innovation, integrity, and sustainable growth.

Financial Requirements and Reporting Frequency : A/I LFMCs vs. RFMCs

Source : Consultation Paper on Repeal of Regulatory Regime for Registered Fund Management Companies (24 October 2023)

Conclusion: Embracing Change for Industry Advancement

The repeal of the RFMC regime marks a significant milestone in Singapore’s fund management industry. MAS’s decision reflects a strategic commitment to fostering innovation, integrity, and sustainable growth. Through collaborative efforts and ongoing stakeholder engagement, MAS aims to ensure a smooth transition for industry participants while upholding the highest standards of regulatory excellence.

As Singapore positions itself as a global financial hub, the repeal of the RFMC regime sets the stage for a more streamlined and dynamic fund management landscape, driving innovation and opportunity in the years ahead. It’s imperative for fund managers to stay abreast of regulatory changes and embrace the evolving industry dynamics for long-term success and resilience.

By adhering to regulatory standards and leveraging transitional arrangements, fund managers can navigate the transition to the A/I LFMC license with confidence and readiness, contributing to a vibrant and sustainable fund management ecosystem in Singapore.

Outsource compliance for your MAS registered fund management company in Singapore. Reduce costs, get expert advisory, and stay on top of evolving MAS regulations.

Streamline MAS filings and policy review with an outsourced compliance officer. Ensure MPI license compliance for your Singapore business.

Explore SFO, MAS Licensed, CMS License requirements for 13O, 13U, and AML/CFT policy in Singapore.