by jiawen

Share

Share

Key Areas Covered in the Information Paper

No. 1: Governance

- Board and senior management play an important role in setting the right tone from the top and fostering a strong AML/CFT culture

- Establishment of a three lines of defence model to maintain a sound AML/CFT risk management

- Ensure that the staff especially those from the compliance team and internal audit function are aware of the regulatory developments and latest AML/CFT matters

No. 2: Risk Assessment Frameworks

- Review the Enterprise-wide Risk Assessment (EWRA) on a periodic basis

- To assess the relevant risk factors such as customer risk profile, delivery channels and type of products and services offered

- Ensure consistency of the rating framework applied at the individual customer level and the enterprise-wide level

No. 3: Customer Due Diligence (CDD)

- Conduct ongoing screening to identify adverse news associated with an individual or its relevant parties

- Perform transaction monitoring across multiple accounts held under the same individual to promptly detect and report any suspicious or unusual transaction patterns

- Periodic review of business relations that covers the relevant ML/TF risk areas such as (i) changes in existing customers’ CDD data, documents and information, (ii) outcomes of screening checks, and (iii) results of transaction monitoring

No. 4: Enhanced CDD

- Perform enhanced CDD measures on customers with high ML/TF risks including PEPs, close relatives of PEPs

- Adequate corroboration of customer’s source of wealth (SOW) and source of funds (SOF)

No. 5: Suspicious Transactions Reporting (STR)

- To file an STR with the Suspicious Transaction Reporting Office (STRO) whenever there are reasonable grounds to suspect that the transaction or activity could involve money laundering or terrorist financing

Summary

Last month, the MAS has imposed a composition penalty of $375,000 on a capital markets services (CMS) licensee for failing to comply with business conduct and AML/CFT requirements. The breaches of AML/CFT requirements include its failure to conduct proper due diligence which may hinder the detection of any suspicious transactions as well as its failure to verify customers’ source of wealth especially those who present a higher ML/TF risk. In conclusion, all financial institutions including the CMS licence holders should implement appropriate AML/CFT frameworks and controls commensurate with the nature of their products/ services and the profile of their customers.

How We Can Help

- Review existing AML/CFT policy to ensure company’s regulatory compliance

- Assist to draft a new AML/CFT policy that aligns with MAS requirements

- Provide Compliance & AML Training

- Provide ongoing compliance advice

Reference Materials

Monetary Authority of Singapore (2022). ‘Strengthening AML/CFT Practices for External Asset Managers’. Available at: https://www.mas.gov.sg/-/media/MAS-Media-Library/publications/monographs-or-information-paper/CMI1/2022/Strengthening-AML_CFT-Practices-for-External-Asset-Managers.pdf

Yong, H.T. (2022). ‘UOB Kay Hian fined S$375,000 for business conduct compliance failures’, The Business Times, 1 September. Available at: https://www.businesstimes.com.sg/companies-markets/uob-kay-hian-fined-s375000-for-business-conduct-compliance-failures

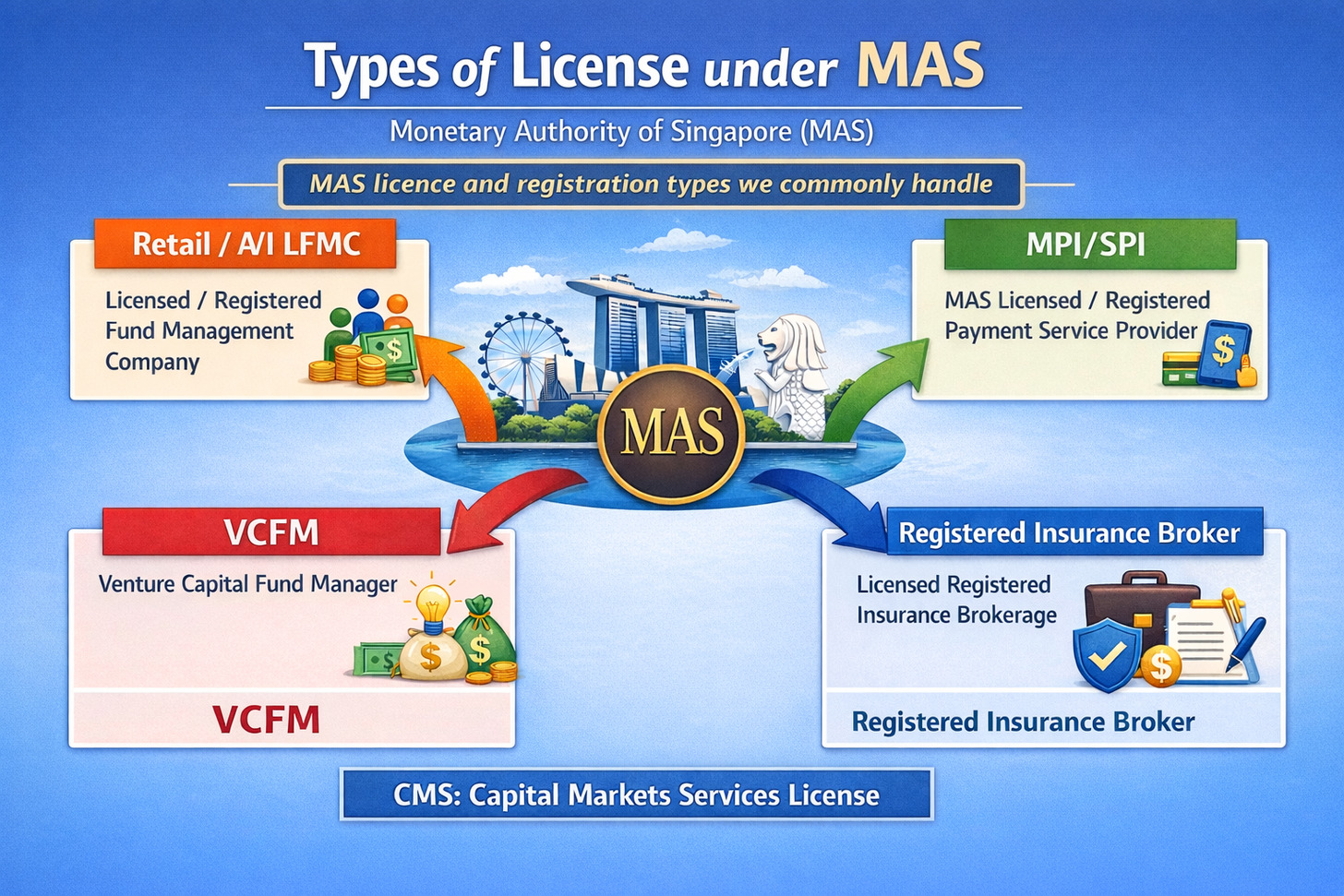

Outsource compliance for your MAS registered fund management company in Singapore. Reduce costs, get expert advisory, and stay on top of evolving MAS regulations.

Streamline MAS filings and policy review with an outsourced compliance officer. Ensure MPI license compliance for your Singapore business.

Explore SFO, MAS Licensed, CMS License requirements for 13O, 13U, and AML/CFT policy in Singapore.