by jiawen

Share

Share

Singapore’s efforts towards sustainability

As reported by CNA in 2020, the Senior Minister Teo Chee Hean has announced the plan for Singapore to halve its 2030 peak greenhouse gas emissions by 2050 and achieve net-zero emissions possibly by the second half of the century. Although Singapore contributes only 0.1% of global greenhouse gases, achieving environmental sustainability remains a challenge to Singapore. Despite high awareness of environmental issues, the adoption of green practice is still lagging behind. This happens especially when the perceived cost of transition is high and when it is likely to cause inconvenience. Thus, the government has unveiled the Singapore Green Plan 2030 early last year to bolster sustainable development of the nation.

What is covered in Green Plan 2030?

The Green Plan outlines several concrete green targets for the next 10 years, including but not limited to the following:

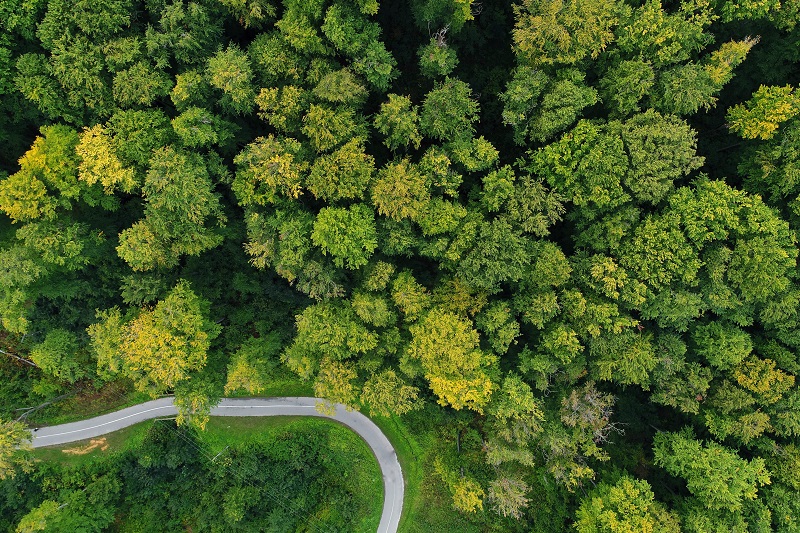

- Creating a green environment for Singaporeans by doubling annual tree planting

- Reducing household water consumption to promote sustainable living

- Encouraging the use of existing public transportation which can lower the carbon footprint

- Better water conservation and waste management

- Improving energy efficiency and promoting the use of renewable energy for buildings

- Adopting the best-in-class approach to sustainability investments

Summary

To avoid catastrophic impacts such as extreme weather events and depletion of natural resources, it is vital for companies in both public and private sectors to start embracing ESG practices. In Alder, our team of experts are able to help clients who are asset managers, investors and portfolio companies with the integration of ESG strategies into their processes and operations.

How We Can Help

While moving towards a more sustainable economy, Alder helps integrate the ESG framework into your business. Our services include:

- Assisting to set up ESG frameworks

- Providing support on ESG reporting

- Providing ongoing ESG advice and support

- Facilitating effective communication of the company’s ESG approach with internal and external stakeholders

- Reviewing and rating the existing governance framework

Reference Materials

Ang, H. M. and Mohan, M. (2021). ‘Singapore unveils Green Plan 2030, outlines green targets for next 10 years’, CNA, 10 February. Available at: https://www.channelnewsasia.com/singapore/singapore-green-plan-2030-targets-10-years-1883021

Meisenzahl, M. (2021). ‘Amazon’s first electric delivery vans are now making deliveries — see how they were designed’, Business Insider, 4 February. Available at: https://www.businessinsider.com/amazon-creating-fleet-of-electric-delivery-vehicles-rivian-2020-2#:~:text=Amazon%20first%20revealed%20its%20electric,zero%20net%20carbon%20by%202040

Mohan, M. (2020). ‘Singapore targets to halve peak emissions by 2050, achieve net zero emissions ‘as soon as viable’ in second half of century’, CNA, 28 February. Available at: https://www.channelnewsasia.com/singapore/singapore-targets-halve-peak-emissions-2050-achieve-net-zero-emissions-soon-viable-second-half-century-1338776

OCBC Bank (2021). ‘OCBC bank, partnering with Eco-business, launches OCBC climate index to measure environmental sustainability awareness and climate action in Singapore’. Available at: https://www.ocbc.com/iwov-resources/sg/ocbc/gbc/pdf/sustainability/climate-index/media-release.pdf

With growing investor demand for transparency, more companies are publishing sustainability reports — yet many still face challenges with consistent ESG data and reporting standards. Fintech is stepping in to close these gaps. Through initiatives like MAS’s Project Greenprint, Singapore is leading the way in digital ESG reporting with platforms such as ESGenome and ESGpedia. As global frameworks like GRI and TCFD gain traction, companies are encouraged to view sustainability reporting not as a compliance task, but as a vital step toward achieving long-term resilience and net-zero goals.

The majority of today’s investors no longer focus solely on potential returns. Many now look beyond projections to understand how companies achieve their goals responsibly and sustainably. As a result, Environmental, Social and Governance (ESG) factors have become a key consideration in modern investment decisions.

Singapore is stepping up its climate action with a higher carbon tax and stronger green initiatives to drive decarbonisation. Businesses are now encouraged to manage their carbon footprint, explore carbon credits, and strengthen their ESG strategies. By taking proactive steps toward sustainability, companies can stay competitive while supporting Singapore’s transition to a low-carbon future.

Investors today increasingly prioritise companies with strong ESG practices. With growing awareness across all generations in Singapore, sustainability has become a key factor in investment decisions. Businesses that embed ESG into their strategies can enhance long-term value while contributing positively to society and the environment.