by jiawen

Share

Share

This is where Fintech comes into play to bridge the gaps.

In a keynote speech at Swift’s Sibos 2022 conference, the managing director of the Monetary Authority of Singapore (MAS), Mr Ravi Menon has shared some thoughts on how Fintech can potentially play a role in the changing landscape of financial services. Fintech solutions are recognised as the key to unlocking the future of ESG with various innovative products to help address the gaps between ESG data needs and the ESG data available. To harness Green Fintech to enable a more transparent, consistent and comparable disclosure, the MAS has announced plans to launch 4 digital platforms under Project Greenprint.

Project Greenprint which comprises 4 common utility platforms:

(a) Greenprint Marketplace; (b) Data Orchestrator(s); (c) ESG Registry(s) and (d) ESG Disclosure Portal.

Current Progress

On 12 September 2022, MAS has developed an integrated disclosure portal, ESGenome in partnership with Singapore Exchange (SGX) to simplify sustainability reporting and facilitate access to ESG data. It allows the inputs of useful data to map across a range of ESG reporting frameworks. In addition, MAS has launched the ESGpedia registry platform with the help of an industry player, Hashstacs Pte Ltd (STACS) in May this year. The platform serves as a single point of access for financial institutions, corporates and regulatory authorities to verified sustainability data and ESG certifications. Meanwhile, the Data Orchestrator and Greenprint Marketplace which are also housed under Project Greenprint are expected to launch in 2023.

Key Global Trends

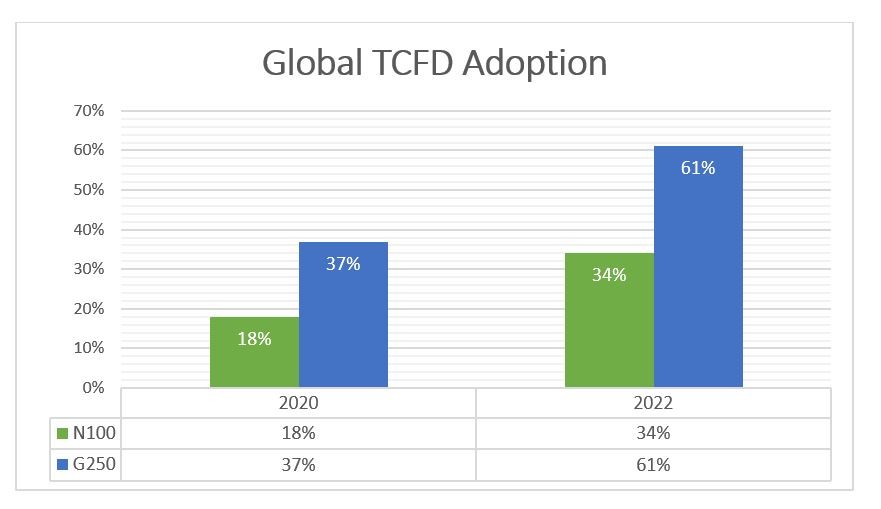

The latest findings by KPMG revealed that the Global Reporting Initiative (GRI) remains the most dominant standards used by companies around the world, with Singapore (100%) as the leader in the adoption of GRI. At the same time, the number of companies adopting Task Force on Climate-related Financial Disclosures (TCFD) recommendations are rising significantly over the past few years. The adoption of TCFD framework continues to grow as it helps companies to assess and disclose their climate-related risks and opportunities for better risk management and decision making. In summary, sustainability reports should not be deemed as a box-ticking exercise, but instead it should be a key concern for all companies as it helps them to develop sustainable strategies and get closer to net zero carbon emissions.

Global TCFD Adoption (2020 vs. 2022)

*G250 refers to the world’s 250 largest companies by revenue based on the 2021 Fortune 500 ranking. N100 refers to a worldwide sample of the top 100 companies by revenue in 58 countries, territories and jurisdictions. Source: KPMG Survey of Sustainability Reporting 2022

Reference Materials

KPMG International (2022). ‘KPMG Survey of Sustainability Reporting 2022’. Available at: https://assets.kpmg/content/dam/kpmg/xx/pdf/2022/10/ssr-small-steps-big-shifts.pdf

Monetary Authority of Singapore (2022). ”Two Problems for FinTech to Solve: Cross-Border Payments and ESG Data” – Keynote Speech by Mr Ravi Menon, Managing Director, Monetary Authority of Singapore, at Sibos 2022 on 10 October 2022’. Available at: https://www.mas.gov.sg/news/speeches/2022/two-problems-for-fintech-to-solve

The majority of today’s investors no longer focus solely on potential returns. Many now look beyond projections to understand how companies achieve their goals responsibly and sustainably. As a result, Environmental, Social and Governance (ESG) factors have become a key consideration in modern investment decisions.

With growing investor demand for transparency, more companies are publishing sustainability reports — yet many still face challenges with consistent ESG data and reporting standards. Fintech is stepping in to close these gaps. Through initiatives like MAS’s Project Greenprint, Singapore is leading the way in digital ESG reporting with platforms such as ESGenome and ESGpedia. As global frameworks like GRI and TCFD gain traction, companies are encouraged to view sustainability reporting not as a compliance task, but as a vital step toward achieving long-term resilience and net-zero goals.

Singapore is stepping up its climate action with a higher carbon tax and stronger green initiatives to drive decarbonisation. Businesses are now encouraged to manage their carbon footprint, explore carbon credits, and strengthen their ESG strategies. By taking proactive steps toward sustainability, companies can stay competitive while supporting Singapore’s transition to a low-carbon future.

Investors today increasingly prioritise companies with strong ESG practices. With growing awareness across all generations in Singapore, sustainability has become a key factor in investment decisions. Businesses that embed ESG into their strategies can enhance long-term value while contributing positively to society and the environment.