by jiawen

Share

Share

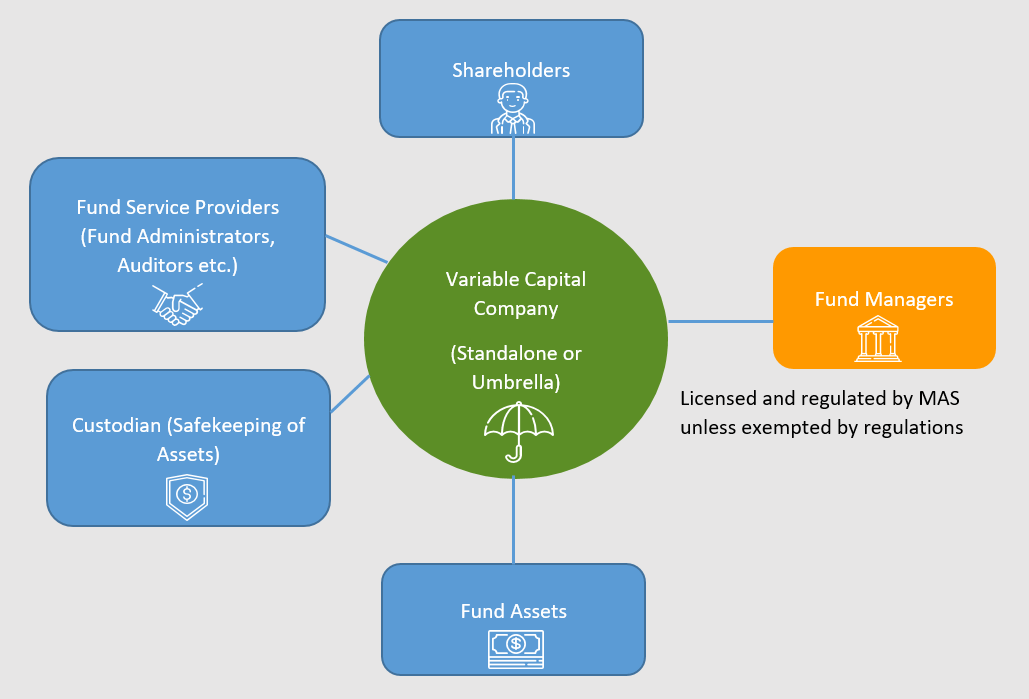

Singapore Variable Capital Company (VCC) Structure

Based on the latest asset management survey of MAS, more than 400 VCCs have been set up since the introduction of the framework early in the year 2020. These VCCs are setting up to manage either a single standalone fund or an umbrella fund with multiple sub-funds. The implementation of tax benefits for Singapore fund managers have made offshore jurisdictions less appealing. This will result in an increasing inflows of offshore funds from tax havens like Cayman Islands and Bahamas to Singapore. To further encourage the adoption of VCCs, MAS has implemented a VCC Grant Scheme that provides a grant of up to S$150,000 for each application. Overall, with the increasing number of VCC structures, we can expect the asset under management (AUM) of Singapore to rise even higher than the 17% growth in 2020.

On the other hand, there is a rising trend of setting up single-family offices (SFOs) in Singapore to manage the assets of families. As highlighted by the chief executive of Gordian Capital, Mark Voumard during an interview session with Asian Investors, the MAS is looking to revise its VCC fund structure to expand the use of VCC and allow a wider pool of fund managers including SFOs to setup their own VCC structures. If this is to be implemented in the near future, the VCC structure will definitely help to strengthen Singapore’s competitiveness as a global financial hub.

Conclusion

In the meantime, unless it is qualified for an exemption, all VCCs in Singapore have to be managed by a Capital Market Services (CMS) licence holder or a licenced fund management company (LFMCs). Global fund management companies such as Fullerton Fund Management and UOB Venture Management have expanded their footprints in Singapore through the adoption of VCC framework. If you’re considering to set up a fund management company to manage the VCCs, feel free to reach out to us to find out more on the licensing requirements and the application process.

How We Can Help

Alder offers integrated solutions for clients who wish to set up a fund management company in Singapore which include:

- Offer Professional Advice on the Specific Licence Requirements

- Assist with the CMS Licence Application

- Assist with the Registration as an LFMC

- Review the Submission Documents (Form 1A, Form 3A, Form 11, Form 22A whichever applicable)

- Liaise with MAS on Licence Application-related matters

- Provide On-going Compliance Support Post-Licence Approval

Reference Materials

Joe, M. (2021). ‘Singapore eyes VCC changes to reel in more family offices’, Asian Investor, 2 May. Available at: https://www.asianinvestor.net/article/singapore-eyes-vcc-changes-to-reel-in-more-family-offices/469259

Monetary Authority of Singapore (2021). ‘2020 Singapore Asset Management Survey’. Available at: https://www.mas.gov.sg/-/media/MAS-Media-Library/publications/singapore-asset-management-survey/Singapore-Asset-Management-Survey-2020.pdf

Singapore remains one of the world’s top destinations for fund managers, managing S$6.07 trillion in assets as of December 2024. To operate locally, all fund management companies must be licensed or registered with the Monetary Authority of Singapore (MAS) under the Securities and Futures Act (SFA). This guide outlines the key licensing requirements under MAS’s latest framework.

On 25 September 2025, the Monetary Authority of Singapore (MAS) issued the Guidelines on Standards of Conduct for Digital Advertising Activities. These new rules, effective 25 March 2026, apply to all financial institutions (FIs) and their appointed digital marketers — including agencies, affiliates, and influencers (“finfluencers”).

Following Russia’s invasion of Ukraine, Singapore imposed targeted financial measures under MAS’s notice dated 13 March 2022. These measures prohibit financial institutions from conducting transactions or providing financial assistance to designated Russian banks, entities, and individuals. Institutions must freeze related assets and restrict dealings involving controlled strategic or dual-use goods bound for Russia. MAS’s directive highlights the importance of vigilance, robust due diligence, and strong compliance controls to ensure adherence to Singapore’s sanctions regime.

As Singapore positions itself as a global FinTech hub, cryptocurrency activities are gaining traction under tighter regulatory oversight. The Monetary Authority of Singapore (MAS) now requires all Digital Payment Token (DPT) service providers to be licensed and meet stringent AML/CFT and technology risk management standards. Whether you’re an exchange operator or an investor exploring the digital asset space, understanding the Payment Services Act is essential to staying compliant and future-ready.