by jiawen

Share

Share

The Payment Services Act – Singapore

Singapore’s novel Payment Services Act is currently under effect and it focuses on the unification and streamlining of the regulatory requirements concerning several payment services prevalent in the country. These include electronic-based payments, exchange services and other crypto token dealings. The act was passed within the Parliament of Singapore on 14th January 2019. The 7 licensable payment services under the regulation of the act include

- Account issuance services,

- International money transfer services,

- National or domestic money transfer services,

- e-Money issuance services,

- Merchant acquisition services,

- Money changing services, and

- Digital payment token services.

Considering the account issuance service, it concerns the opening and maintaining payment accounts authorized to an individual in Singapore, or a specific service concerned with the operation of managing a payment account. It involves a particular type of service except for the domestic/national money transfer service and other international money transfer services. It further enables the funds to be deposited in or withdrawn from the payment account. In the context of “payment account”, it can be referred to any facility, device or account within an electronic or physical form.

For instance, if a service provider offers the service of e-wallet, then he is performing account issuance services. The act requires the operators of all types of payment services to acquire licensing as per the form of payment service. Although, they would not need to acquire any license if their business is under any exemption. These businesses are required to forward an application to MAS to get the relevant license.

Types of Licenses under the Payment Services Act

The Payment Services Act has underlined three types of licenses within its framework. These include:

- Money Changing License

- Standard Payment Institution License

- Major Payment Institution License

It further applies varying requirements as per the risks imposed following the scale and scope of the services delivered by the licensee. Licensing requirements have been exempted for the merchant banks, Singapore-licensed banks, credit card and charge card issuers, finance companies. Although, they are required to follow all the obligations outlined in the act.

Key Regulatory Requirements

The Payment Services Act has several key regulations. The following regulations apply to all the licensees.

- All the licensees are subjected to licensing, lapsing/surrender/revocation and distinguishing of licensing along with solicitation prohibition along with the utility of annual license fees and unlicensed agents.

- The company or the payment business should work within Singapore, and there needs to have a director of the business domiciled and working in Singapore.

- Businesses need to fulfil all their financial requirements, except for money changers.

- The submission and notification of regulatory and info returns should be given to MAS.

- The CEO, 20% of controllers and stakeholders along with the company’s director should be approved by the MAS. They are required to fulfil the criteria set by the authorities.

- Businesses are required to fulfil the audit requirements and also conduct investigations and inspections from MAS.

- The company’s need to take care of technology risk management

- They should not cater provisions related to credit facilities against individuals.

In case of failure to any of these regulatory requirements, the businesses would be subjected to restriction on their payment transactions for 6 months, ceasing of their payment services for 6 months and inability to commence business within the 6 months of license granting.

Payment Services Act for Digital Payment Tokens (DPT)

The crypto tokens are virtual currencies and along with that utility, tokens were not initially identified by the legislation pursued in Singapore. The Payment Services Act has established a definition concerning the term “digital payment token”, and it can be referred to as any of the digital manifestations of value within a certain unit. It is not denominated within a currency apart from not being pegged to a specific currency. The token or digital representation is intended to convert itself within an exchange medium that is supposed to be accepted by the public in form of payment. It is also expected to be traded, stored and transferred through electronic means.

The utility tokens are usually not counted within the regulation of MAS in the form of a financial product, although the transactions made by the intermediaries after the application of the Payment Services Act is required to attain a license and further ensure their legal existence as digital payment tokens.

E-Money Operators & Digital Payment Token (DPT) Service Providers

The Payment Services Act has applied a regulatory framework for the review and supervision of payment services under e-money concepts. The PSA aims to mitigate the identified risks associated with different payment services. Following this concept, the DPT services are specifically associated with money laundering and financial terrorism risks. On the other hand, e-money services are highly prone to a considerable range of risks including customer protection. Although, the DPT services are subjected to CFT and AML requirements and the e-money services do not have those requirements.

As a conjecture, the Payment Services Act enacted in Singapore has regulatory guidelines concerning overall digital payment services and related transactions and dealings. The act encompasses requirements related to the use of digital or technological aids for performing financial activities. It further represents adequate requirements to ensure the evasion of risks and concerns underlined in the existing operational framework of these payment services.

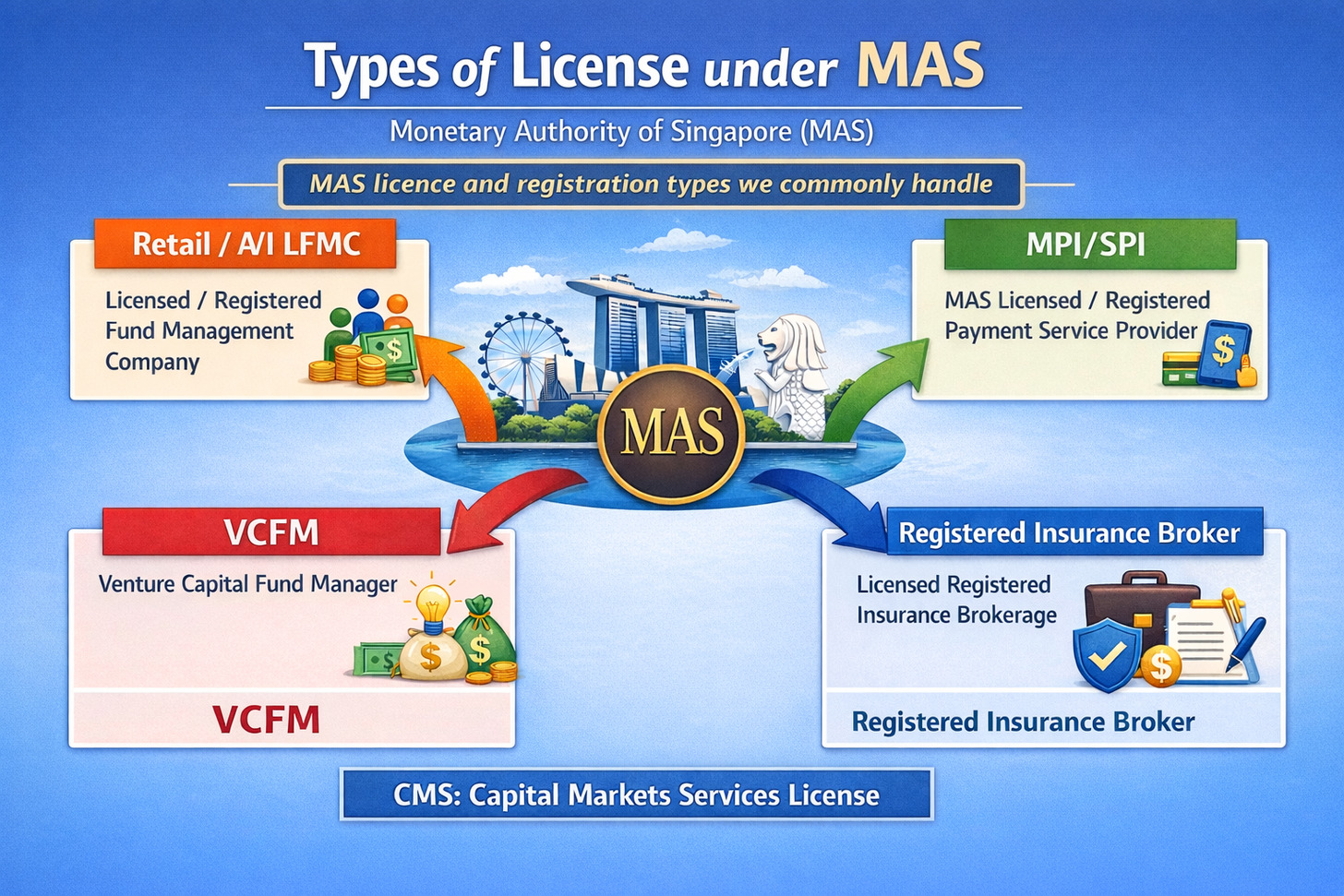

Outsource compliance for your MAS registered fund management company in Singapore. Reduce costs, get expert advisory, and stay on top of evolving MAS regulations.

Streamline MAS filings and policy review with an outsourced compliance officer. Ensure MPI license compliance for your Singapore business.

Explore SFO, MAS Licensed, CMS License requirements for 13O, 13U, and AML/CFT policy in Singapore.