by jiawen

Share

Share

What is a Collective Investment Scheme?

CIS is a financing system in which several individuals put their money together to invest in one grouped asset. Profits from their investment are then distributed on a pre-agreed basis and shared among the investors.

The CIS is basically a deal signed by all participating investors with the following conditions:

- No participant will have routine control over asset management throughout the process.

- To meet either one or both of these standards:

a) The chosen asset will be managed on behalf of or completely by the Fund Manager

b) All participants will contribute to the investment together. Profits of which will be pooled.

- The objective of this agreement is to allow the investors to put their funds in the right asset and get better profits from the process.

Requirements for Proper CIS

All offers of units for properties under the scheme are administered under Part XIII, Division 2 of the SFA, for investors from Singapore. Other than exceptions, the offer of units in all CIS agreements should conform with the following:

- In Singapore, all CIS agreements should be authorised by MAS. If the fund is domiciled outside Singapore, they must at least receive MAS recognition to be marketed / sold to Singaporean entities.

- All CIS agreements and offer of units should come with an MAS-approved prospectus and a product highlights sheet.

CIS and Fund Managers or Trustees should also abide by the MAS code of conduct.

A) Authorisation

If you need CIS authorisation, as stated above, you may use Form 1 provided. MAS will authorise the offers of units if:

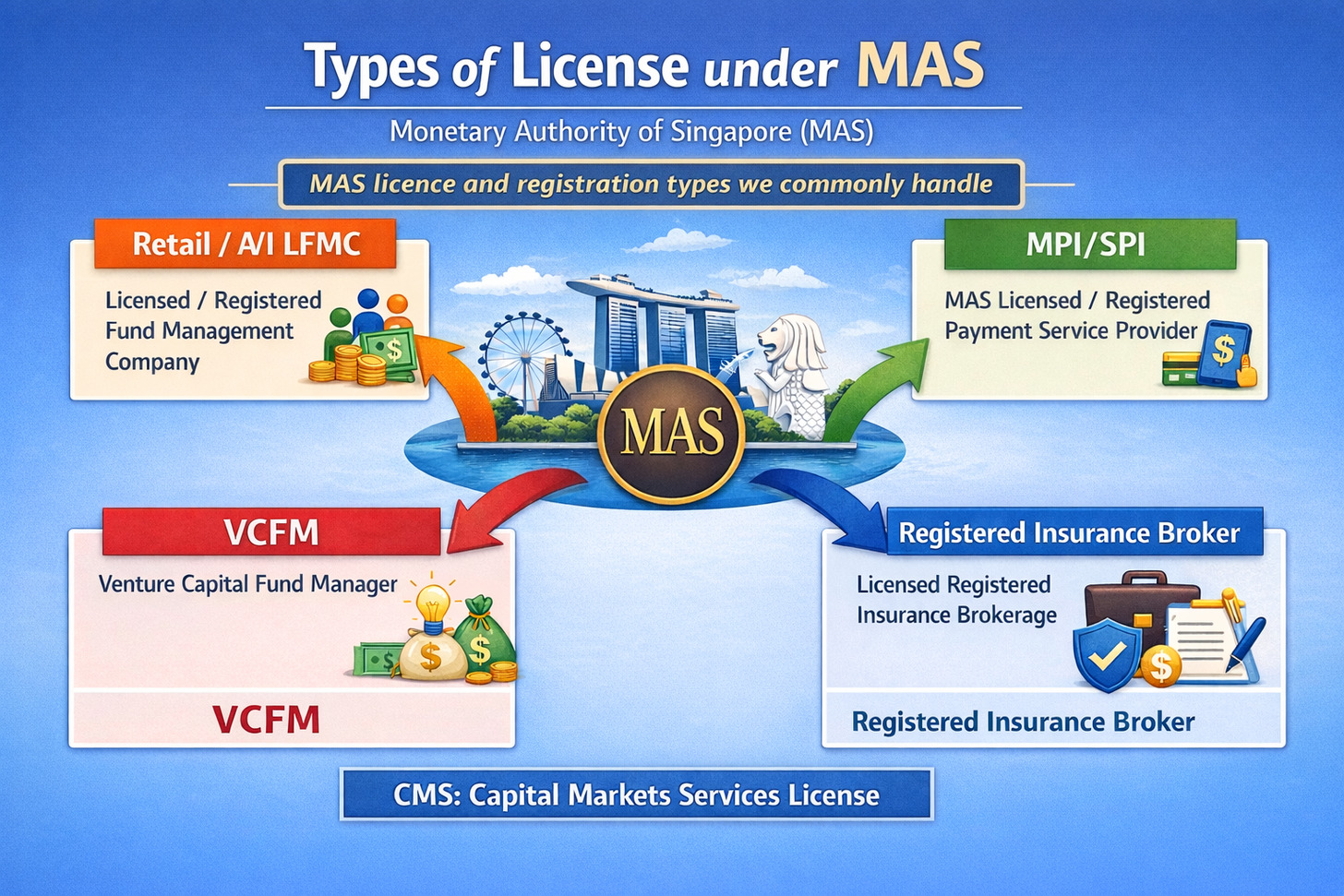

- The Fund Manager has a Capital Markets Services licence

- The offer has a Trustee, amissible by the Section 289 under SFA.

B) Recognition

Investors may use Form 2 to get CIS recognition. MAS provides recognition in the following cases:

- The Funds Manager has a license or has principal place of business regulation

- The investors have appointed a Singapore representative

- The safety provided should be equal to other Authorised schemes and conform to laws or regulations of the CIS jurisdiction.

Exemptions for Offer in Units

In both cases, recognition or authorisation, the CIS agreement and prospectus registration have certain requirements. However, these do not apply to the offer in some cases. These are called Exempt Offers and include the following:

- Small Offers: The total raised amount in these must be S$5 million in less than 1 year.

- Private Placement: These are the offers given to 50 or less people within 12 months.

- Offers aimed at Institutional or Accredited investors only

Exempted Offers are subjected to certain other terms, for instance non-disclosures and advertising for investors.

More information can be found in Part XIII, Division 2- Subdivision, of the SFA.

Workings of a Collective Investment Scheme

In a CIS, the investors pool their funds together to invest in one single asset. This helps in securing a bigger capital and gain higher profits compared to their revenue as individual investors. The investment in funds is split into units.

In simple terms, the number of units an investor owns is the proportion of the asset ownership s/he has. It also defines one’s capital growth and income from the particular investment. The prices for these may vary based on the rise and fall of the value of the purchased asset.

As the number of units determines the fund value, it will also impact the individual income. Additionally, each fund has a different risk level. While some only require less risk, for instance investing in cash based assets, there are others with higher risk factors, like investing in entrepreneurial ventures, risky stocks or exotic products to get quicker and higher income.

Hence, one is always recommended to receive professional guidance before selecting a fund. This will help you pick a befitting asset that goes perfectly with your risk profile. Make sure you consider the following:

- Financial Condition

- Fund Knowledge

- Investment Objectives

- Risk Appetite

Restricted Schemes

Besides Exempted Offers, a CIS also has Restricted Schemes, which are only provided to a few people. The eligibility is stated in Section 305(5) SFA. It also states that these “relevant” people must have at least a minimum of S$200,000 per transaction.

In case of registering as a Restricted Scheme, the investors will have to provide a notification to MAS. Upon approval, the fund will be listed within the MAS Restricted Scheme listing before the fund can then be setup and marketed.

For MAS approval in the Restricted Scheme:

- The Offer should be made with or complying by the information memorandum, which provides primary knowledge on the restricted schemes.

- The investors have a licensed Fund Manager that has proper means to manage the scheme asset by the jurisdiction of the place of business.

There are also Restricted Non-Capital Market Products (CMP) Schemes, which are similar to restricted schemes but do not invest on products from the capital market. These are generally provided to relevant persons only and do not require having a manager with a license.

This is why investors do not have to register these with MAS Restricted Scheme listing. However, they will have to provide certain data before making an offer to the MAS by the CISNet website.

Outsource compliance for your MAS registered fund management company in Singapore. Reduce costs, get expert advisory, and stay on top of evolving MAS regulations.

Streamline MAS filings and policy review with an outsourced compliance officer. Ensure MPI license compliance for your Singapore business.

Explore SFO, MAS Licensed, CMS License requirements for 13O, 13U, and AML/CFT policy in Singapore.