by jiawen

Share

Share

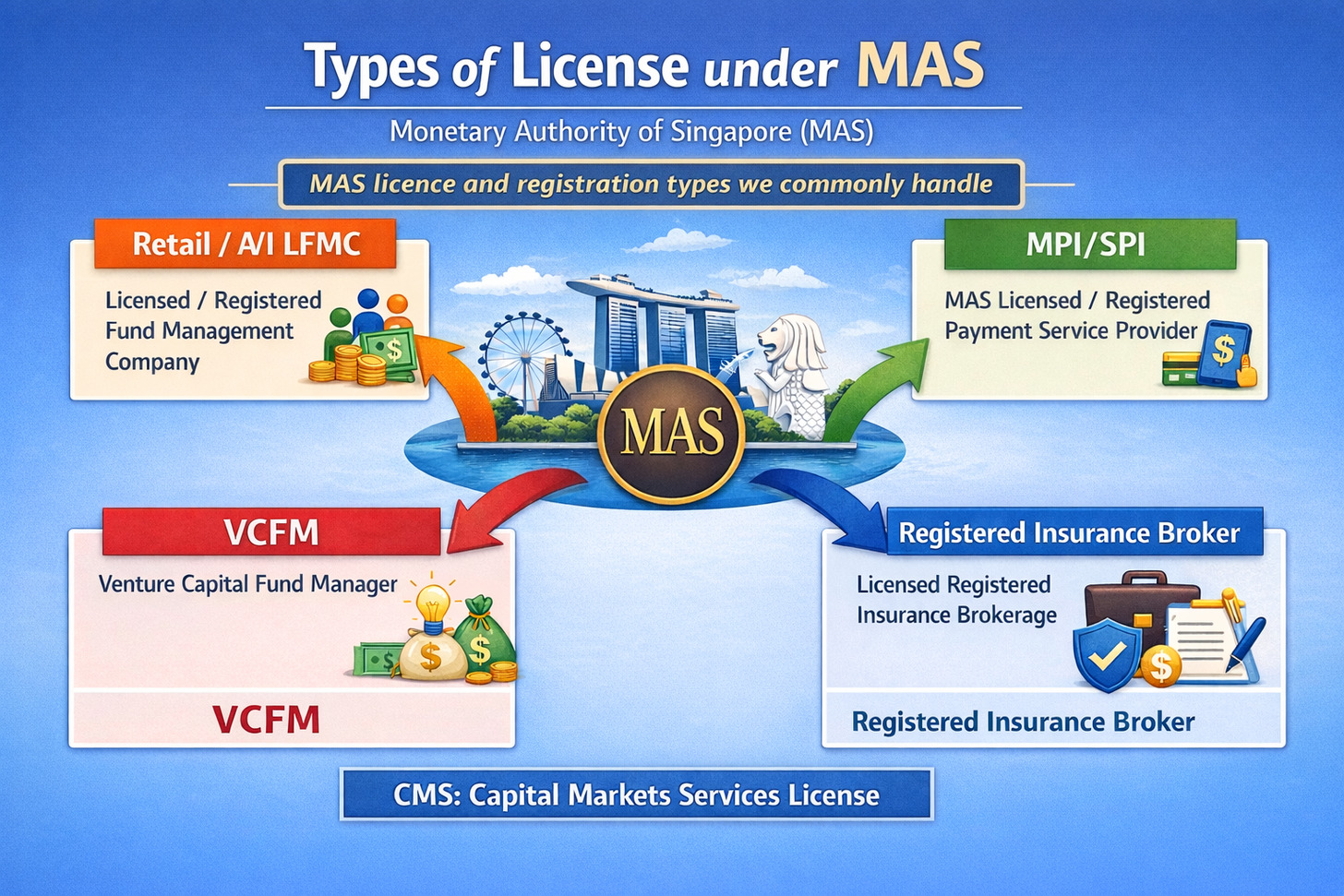

1. Types of Fund Management Licences

- Retail Licensed Fund Management Company (Retail LFMC):

May manage funds for all investor types, including retail investors. Subject to the highest capital and compliance requirements. - Accredited / Institutional Licensed Fund Management Company (A/I LFMC):

May serve accredited and institutional investors only, with lighter regulatory obligations than Retail LFMCs. - Venture Capital Fund Manager (VCFM):

Manages venture capital funds for qualified investors, focusing on early-stage, unlisted businesses under MAS’s VC fund eligibility rules.

2. Capital Requirement

FMCs must maintain the following minimum base capital as set out by the Monetary Authority of Singapore (MAS):

S$1 million – For FMCs managing Collective Investment Scheme (CIS) funds for non-accredited / institutional investors.

S$500,000 – For FMCs managing non-CIS funds for non-accredited / institutional investors.

S$250,000 – For FMCs managing funds for accredited / institutional investors only.

Licensed Fund Management Companies (LFMCs) must also maintain financial resources of at least 120% of total risk requirement to ensure adequate liquidity and operational soundness.

3. Competency Requirement

FMCs must appoint qualified and fit-and-proper personnel with relevant experience and Singapore presence.

- CEO: Minimum 5 years’ experience (10 years for Retail LFMCs); must be based in Singapore and actively manage daily operations.

- Directors: At least two directors, with one executive director residing in Singapore; each with ≥5 years relevant experience.

- Representatives: Minimum two Singapore-based representatives (three for Retail LFMCs) with appropriate qualifications and experience.

4. Compliance Requirement

FMCs must maintain effective compliance and risk frameworks aligned with business scale and complexity.

Retail LFMCs & A/I LFMCs (AUM ≥ S$1billion):

- Should have an independent compliance function.

A/I LFMCs (AUM < S$1billion);

- May have an independent compliance function

- A senior officer may oversee compliance

- May rely on oversight and support from a compliance team at its holding company or an overseas related entity

- May engage a qualified external service provider if needed.

5. Audit Requirement

FMCs have to meet the MAS’ expectations by performing adequate internal audits, which form part of their annual reporting requirements. The company may fulfil this by maintaining an internal audit team, appointing qualified auditors from the head office, or outsourcing the function to a competent third-party service provider.

In addition, FMCs must meet the independent annual audit requirements set out in the Securities and Futures Act (SFA) and Securities and Futures (Licensing and Conduct of Business) Regulations [SF(LCB)R].

📖 References

Monetary Authority of Singapore. (2025, September 3). Guidelines on Licensing and Conduct of Business for Fund Management Companies (SFA 04-G05). https://www.mas.gov.sg/regulation/guidelines/guideline-sfa-04-g05-on-licensing-registration-and-conduct-of-business-for-fund-managers

Monetary Authority of Singapore. (2024). Singapore Asset Management Survey Report 2024 (as at 31 December 2024). https://www.mas.gov.sg/-/media/mas-media-library/publications/singapore-asset-management-survey/asset-management-survey-report-2024.pdf

Outsource compliance for your MAS registered fund management company in Singapore. Reduce costs, get expert advisory, and stay on top of evolving MAS regulations.

Streamline MAS filings and policy review with an outsourced compliance officer. Ensure MPI license compliance for your Singapore business.

Explore SFO, MAS Licensed, CMS License requirements for 13O, 13U, and AML/CFT policy in Singapore.