by jiawen

Share

Share

1. Banking

Banking activities such as deposit-taking and lending require a banking licence under the Banking Act.

Key entity types include:

Local, Full, Qualifying Full, and Wholesale Banks

Merchant Banks and Finance Companies

Representative Offices and Financial Holding Companies

SGS Primary Dealers

MAS has also introduced digital bank licences to enhance competition and innovation in the sector.

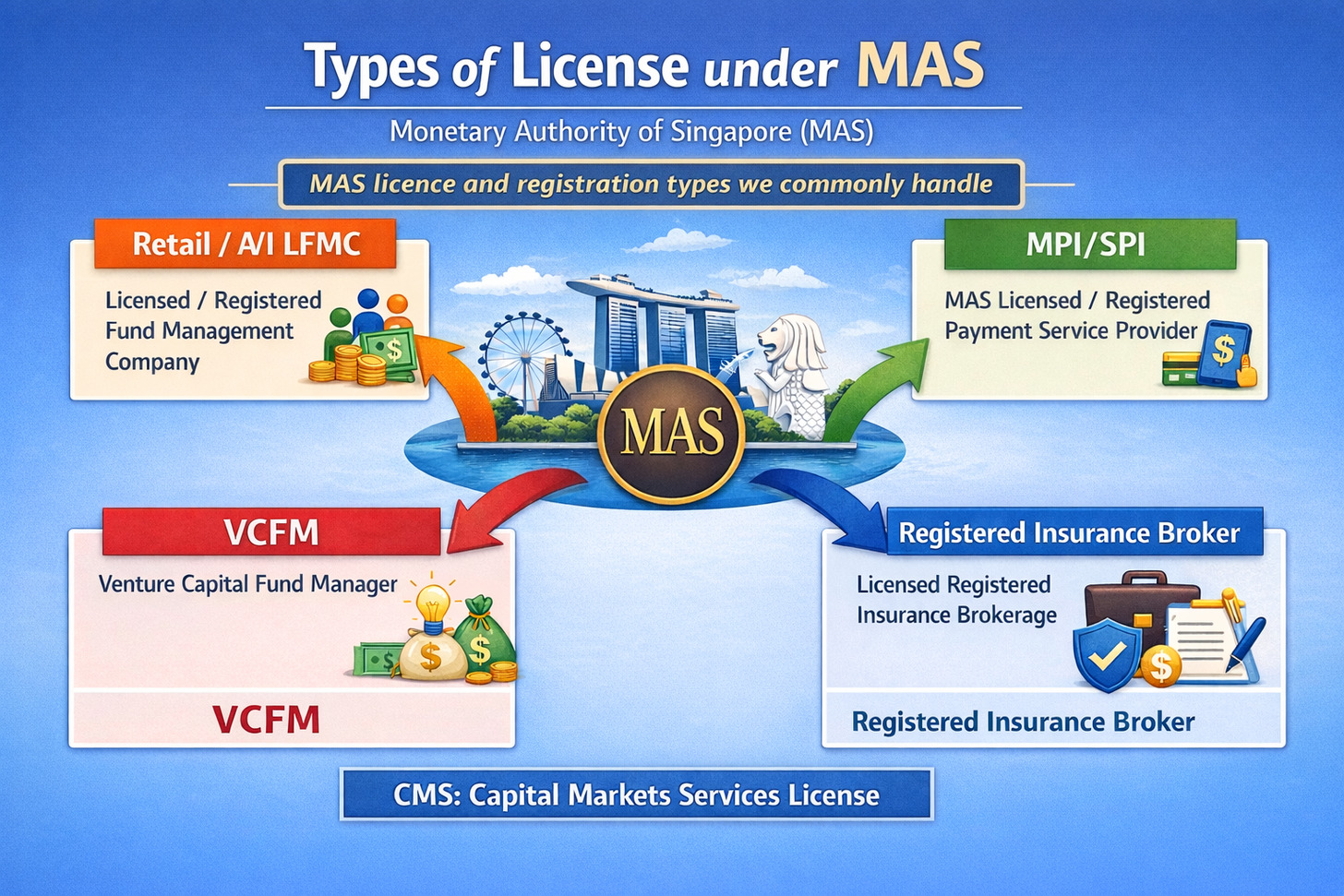

2. Capital Markets

Entities in the capital markets are licensed under the Securities and Futures Act (SFA). They may conduct regulated activities such as:

Dealing in securities or futures

Fund management and corporate finance advisory

REIT management and custodial services

Clearing, settlement, or credit rating services

These intermediaries play a key role in strengthening Singapore’s position as a regional financial hub.

3. Financial Advisory

Financial advisers, regulated under the Financial Advisers Act (FAA), provide investment and insurance advisory services.

MAS licenses:

Licensed Financial Advisers

Exempt Financial Advisers

These advisers ensure clients receive qualified and transparent financial guidance.

4. Insurance

Insurers and brokers are licensed under the Insurance Act. Main categories include:

Direct Insurers (Life, General, or Composite)

Reinsurers and Captive Insurers

Registered or Approved Insurance Brokers

Entities under the Lloyd’s Asia Scheme

This framework ensures sound insurance practices and policyholder protection.

5. Payments

Payment service providers are regulated under the Payment Services Act.

Licences are issued according to seven key activity types:

Account issuance

Domestic and cross-border money transfer

Merchant acquisition

E-money issuance

Digital payment token services

Money-changing services

This flexible structure supports innovation while maintaining financial stability and consumer protection.

The full list of licensed financial institutions is available on the MAS Financial Institutions Directory.

Outsource compliance for your MAS registered fund management company in Singapore. Reduce costs, get expert advisory, and stay on top of evolving MAS regulations.

Streamline MAS filings and policy review with an outsourced compliance officer. Ensure MPI license compliance for your Singapore business.

Explore SFO, MAS Licensed, CMS License requirements for 13O, 13U, and AML/CFT policy in Singapore.