by jiawen

Share

Share

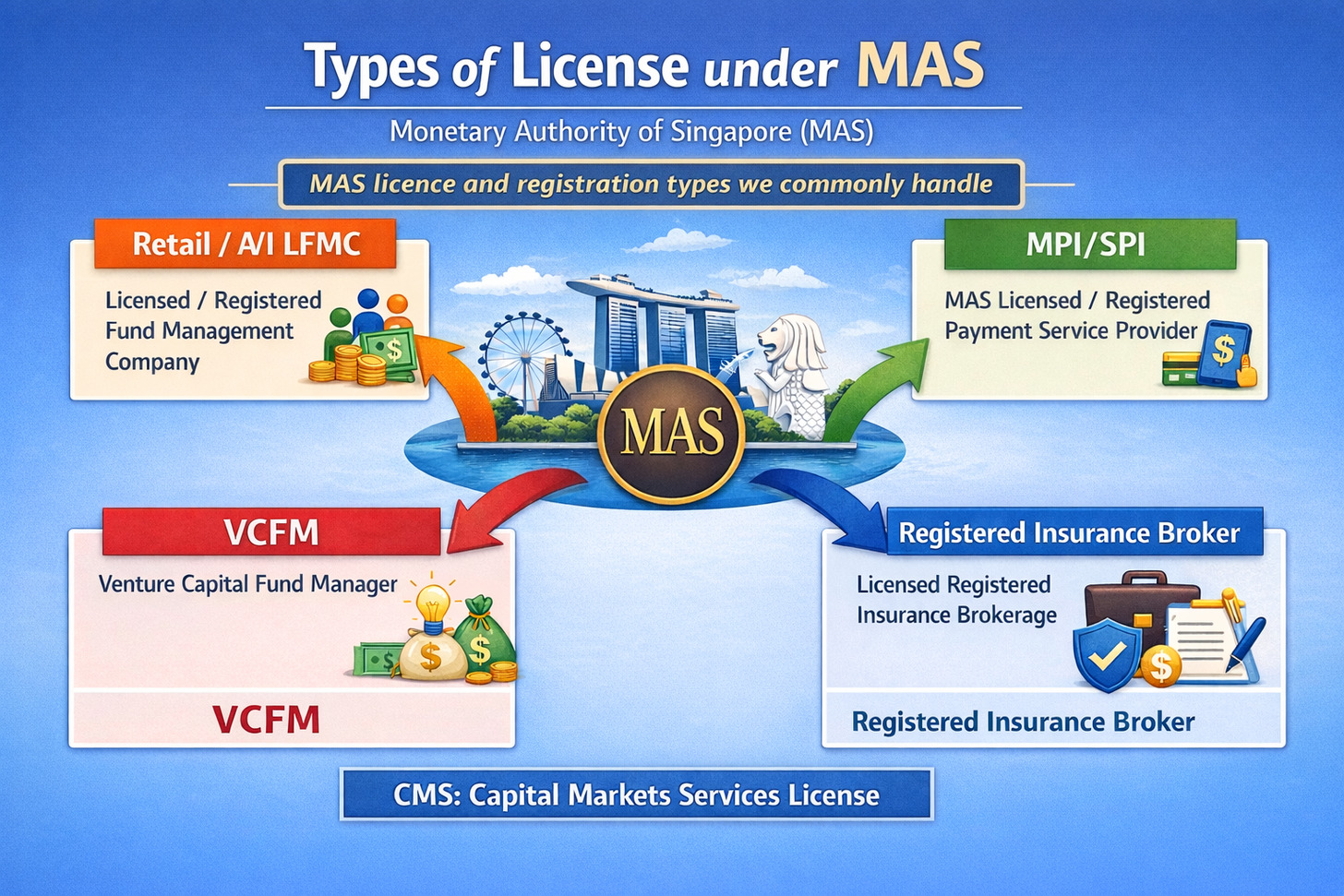

Defining CMS Licence in Singapore

It is under the regulations of the Monetary Authority of Singapore (MAS). All Capital Market Services licence holders can conduct regulated activities like fund management and legally enter into a contract.

Licensing Requirements

As the licence applicant, you will have to fulfil the following criteria:

- At least 2 directors, with 1 of them based in Singapore;

- CEO with at least 10 years relevant experience, resides in Singapore;

- At least 2 full-time representatives who are based in Singapore (except for REIT management);

- Must be able to fulfill the financial requirements that are applicable to the specific regulated activity; and

- Robust risk management framework and compliance structure

Are you intend to apply for a CMS licence for fund management activities, make sure you read this licensing and registration guidelines.

The Application Procedures

If you are interested to apply for a CMS licence, you will need to fill up Form 1 under the Securities and Futures (Licensing and Conduct of Business) Regulations (SF(LCB)R).

You will have to pay for an application fee of $1000 which is non-refundable upon submission of application. If the licence application gets approved, the licence holder will need to pay an annual fee (from $2000 to $8000) depending on the types of regulated activities.

Processing Time for the Licence

If your application is completed with no missing document, the MAS will take around 4 months to review and process the application. In cases where additional documents are required or submission pack is incomplete, we will need to expect a longer time for MAS to process.

Conclusion

Starting a CMS company in Singapore can be a challenging task due to various admission criteria, ongoing requirements and complicated processes. Also, passing the inspections and assessment of the MAS is never an easy task. That’s where Alder comes into action. We assist you in filling in the forms and guide you through in setting out the best possible business plans for assessment. Now, you can forget the hassle of filling forms and waiting, let us work while you can sit back and relax.

Outsource compliance for your MAS registered fund management company in Singapore. Reduce costs, get expert advisory, and stay on top of evolving MAS regulations.

Streamline MAS filings and policy review with an outsourced compliance officer. Ensure MPI license compliance for your Singapore business.

Explore SFO, MAS Licensed, CMS License requirements for 13O, 13U, and AML/CFT policy in Singapore.