by jiawen

Share

Share

What is a Hedge Fund?

A hedge fund is set up with the purpose of getting good returns despite fluctuation of capital markets. The Monetary Authority of Singapore (MAS) describes various investing and funding steps of Singapore along with Collective Investment Schemes. MAS has set out two main criteria in defining a Hedge Fund:

- Adoption of arbitrage, leverage, derivatives, and short selling strategies.

- Investment that involves non-mainstream assets such as cash, bonds, equity, etc.

There are two types of Hedge Funds:

- Onshore Funds: Regulated under the jurisdiction of the Singapore licensing and regulatory regime.

- Offshore Funds: Regulated under the jurisdiction of offshore legislation on account of their constitution outside the country.

Process of Starting a Hedge Fund

Starting a hedge fund requires streamlined licensing and subjects to tax regulatory measures. To start an onshore hedge fund, a fund manager needs to fulfill the following requirements:

- Licensing

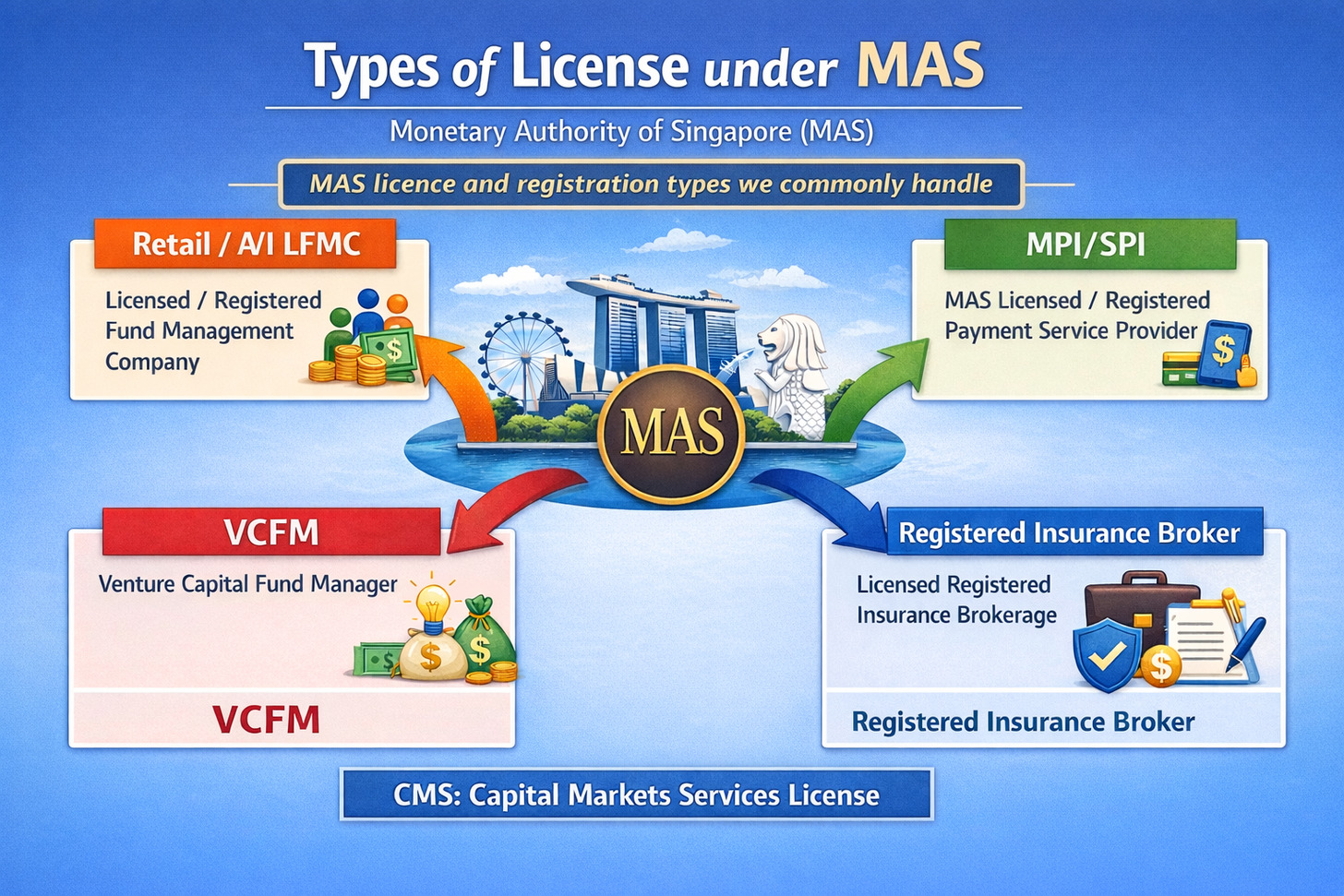

The license requirements for hedge funds vary according to the numbers of investors. Small funds with less than 30 investors can operate without a license. Larger size funds with more than 30 investors need to hold one licence. It can be a Capital Market Services Licence under the Securities and Futures Act (SFA) or Financial Advisers Licence under the Financial Advisors Act (FAA), depending on the nature of business.

- Tax Operations

There are certain exemptions credited to both types of hedge funds. Offshore funds are exempted from paying any Singaporean tax on their ‘specified income’ if the fund falls under the category of ‘qualifying fund’. Similarly, the onshore funds that fulfill the conditions set up by MAS can enjoy the tax exemption benefits through the Singaporean Resident Fund Scheme.

Enhanced Tier Fund Management Scheme

Enhanced Tier Fund Management Scheme has been introduced to lift the restriction on investors’ residency. In addition, when a fund manager markets the onshore or offshore funds to an accredited investor or an institutional investor, they do not need to submit prospectus or any other supporting document to the MAS.

Outsource compliance for your MAS registered fund management company in Singapore. Reduce costs, get expert advisory, and stay on top of evolving MAS regulations.

Streamline MAS filings and policy review with an outsourced compliance officer. Ensure MPI license compliance for your Singapore business.

Explore SFO, MAS Licensed, CMS License requirements for 13O, 13U, and AML/CFT policy in Singapore.