Outsource compliance for your MAS registered fund management company in Singapore. Reduce costs, get expert advisory, and stay on top of evolving MAS regulations.

Streamline MAS filings and policy review with an outsourced compliance officer. Ensure MPI license compliance for your Singapore business.

Explore SFO, MAS Licensed, CMS License requirements for 13O, 13U, and AML/CFT policy in Singapore.

Outsource your insurance broker's compliance needs to Alder - experts in MAS filings, AML/CFT, and Outsourced Compliance.

Venezuela-linked cases can trigger higher sanctions and AML/CFT risk. Alder supports Singapore firms with customer screening and outsourced compliance for peace of mind.

Compliance should not slow a fund down. We support VCFMs with right-sized, cost-efficient compliance that scales as you grow, so you can focus on investing while regulatory expectations are met.

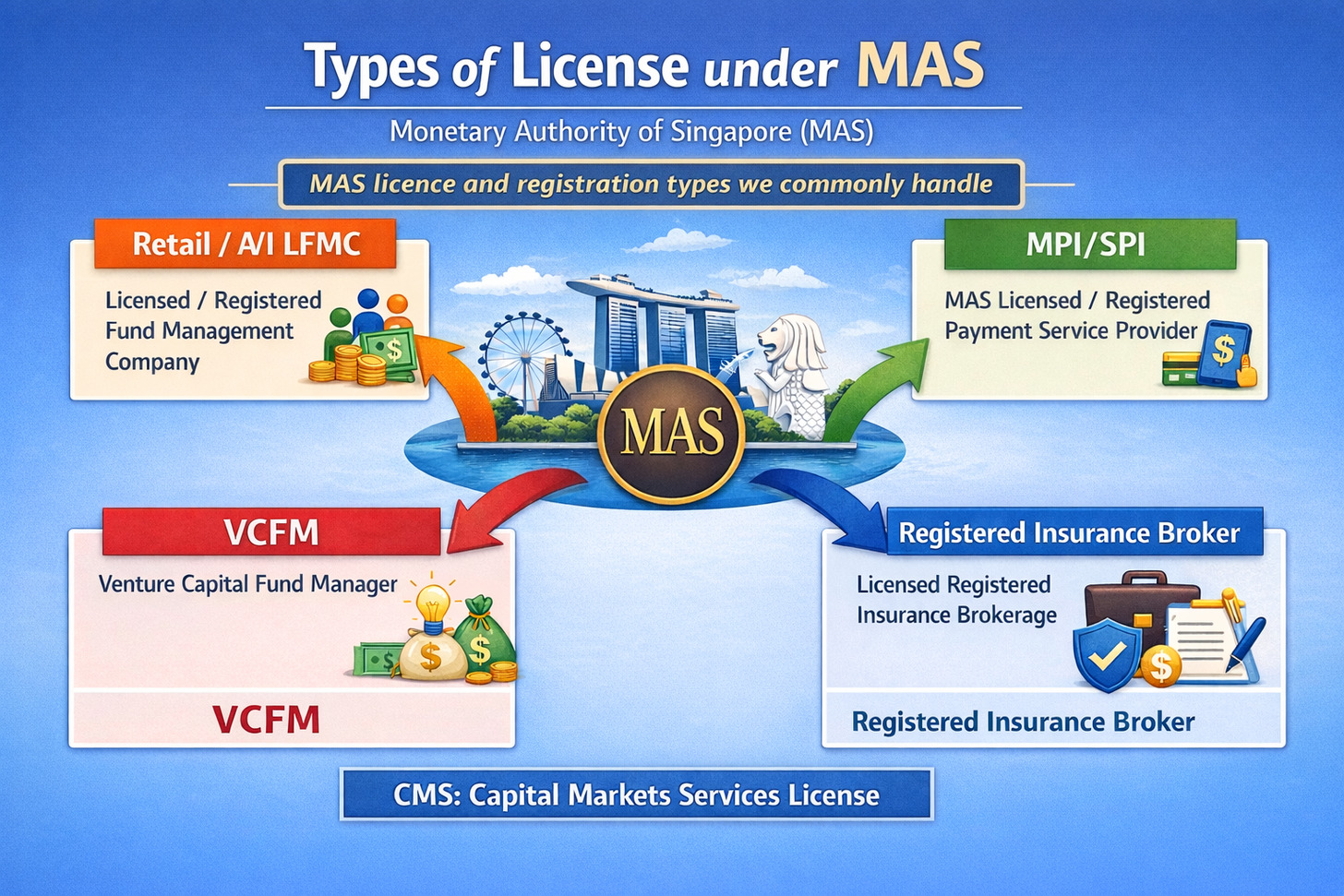

Singapore remains one of the world’s top destinations for fund managers, managing S$6.07 trillion in assets as of December 2024. To operate locally, all fund management companies must be licensed or registered with the Monetary Authority of Singapore (MAS) under the Securities and Futures Act (SFA). This guide outlines the key licensing requirements under MAS’s latest framework.

On 25 September 2025, the Monetary Authority of Singapore (MAS) issued the Guidelines on Standards of Conduct for Digital Advertising Activities. These new rules, effective 25 March 2026, apply to all financial institutions (FIs) and their appointed digital marketers — including agencies, affiliates, and influencers (“finfluencers”).

Following Russia’s invasion of Ukraine, Singapore imposed targeted financial measures under MAS’s notice dated 13 March 2022. These measures prohibit financial institutions from conducting transactions or providing financial assistance to designated Russian banks, entities, and individuals. Institutions must freeze related assets and restrict dealings involving controlled strategic or dual-use goods bound for Russia. MAS’s directive highlights the importance of vigilance, robust due diligence, and strong compliance controls to ensure adherence to Singapore’s sanctions regime.